A Virtual Credit Card (VCC) is a type of credit card which is generated by a credit card issuer for temporary use. After a VCC is generated, you can use the card details (number, expiry, CVV) for an online transaction and then it expires. A VCC comes in handy when you’re afraid of fraudsters stealing your credit/debit card details. Most VCCs are good for a one-time use. So, even if cyber thieves get your card details, they cannot spend your money.

India’s State Bank of India (SBI) recently launched a service to generate Virtual Credit Card (VCC) directly through Internet banking facility. Banks like HDFC, ICICI, and Axis bank are already offering services to create a virtual credit card. State Bank of India (SBI) has now joined the list of banks providing virtual credit card facility in India. And the good thing is that you can create a VCC via SBI online banking within 5 minutes.

Some of the advantages of SBI Virtual Credit card are:

- You can use SBI VCC for online shopping where you are required to pay via a VISA Credit card

- You can see how much money is spent via VCC in OnlineSBI portal

- Payment is debited from your account only when you actually purchase something using your Virtual Credit card

- You can generate a VCC with a denomination ranging from Rs. 100 to Rs. 50,000

- You can cancel VCC at any time

- There is currently no issuance fee or annual fee

- Multiple virtual cards can be created

Some of the disadvantages of SBI Virtual card are:

- SBI VCC cannot be currently used for international transactions

- OTP (One time password) will be generated at the last step of transaction

- 48 hours expiry time

- Virtual cards can’t be used as Gift Card or other Virtual Credit Cards (gifted) as OTP makes it impossible

Grab your SBI account details & follow the tutorial below.

How To Generate SBI Virtual Credit Card via Net Banking?

1. Go to OnlineSBI.com & login into your account

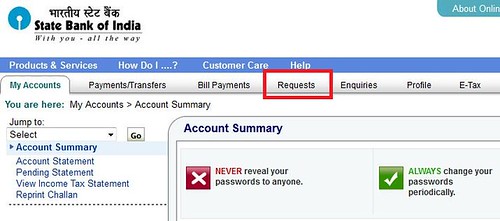

2. After logging in successfully, click Requests

3. On the left side, click State Bank Virtual Card

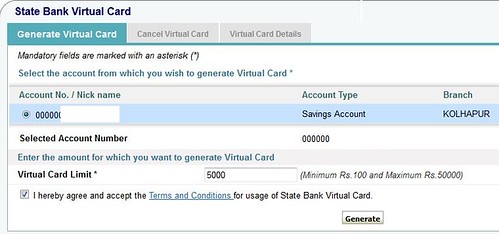

4. Now you’ll be transferred to Generate Virtual Card page. Select your Debit account & specify the limit for Virtual card. Accept the terms and conditions & click Generate

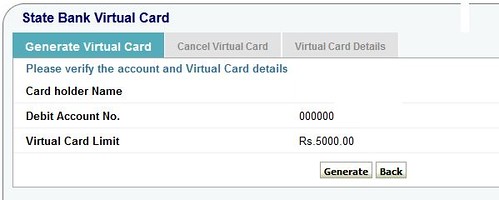

5. You’ll be asked to confirm the details. Click Generate

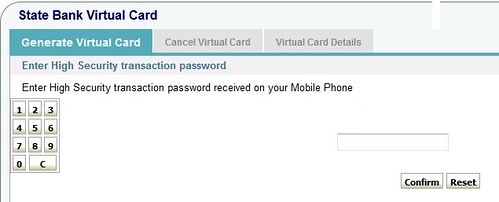

6. On this page, you’ll be shown a screen to enter one-time-password (OTP) which will be sent to your registered mobile number

7. After confirmation, a Virtual credit card will be generated and you can use it immediately for online transactions

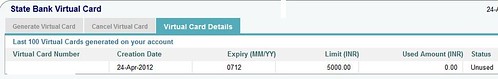

You can view the virtual card details, like the used amount, limit, etc by clicking Virtual Card Details.

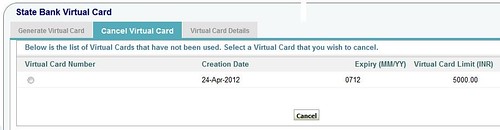

You can also cancel the card anytime. This option is present in Cancel Virtual Card.

Conclusion

I think SBI still has to implement a couple of features like allowing international transactions, removing OTP security feature, and increasing the expiration time. Also, SBI Virtual card does not work with PayPal currently, because SBI doesn’t currently allow transactions in foreign currencies. I’ve tried adding SBI VCC to my PayPal account, but PayPal doesn’t accept this VCC. Hope SBI allows transactions in foreign currencies in future.

You can use SBI Virtual Credit Card for buying items from eBay.in using PaisaPay. This VCC works with all Indian payment gateways.

What do you think of SBI’s VCC? Feel free to comment below.

{ 6 comments… read them below or add one }

i am trying to find out if i can use this vcc to buy things from ebay via paisapay which is the indian version for paypal..i mean i am not sure if the you can buy things from indian sellers only applies to this.any help?

Yes you can use this VCC to buy from eBay via Paisapay. This VCC works with all Indian payment gateways.

Hello Sir have u tried that SBI VCC accepting paypal account. bcoz its very benefit to our indians.

Yes I’ve tried, but SBI VCC doesn’t work with Paypal.

Does this works with Google Wallet?

does it work with apple appstore..?